- ESG RE

- About us

- Certified Asset Design

- Icon Platform

- System Origin

- Fund

- Design

- Asset Mgmt.

- Market

- Portfolio

- Job openings

- Resources

- Contact

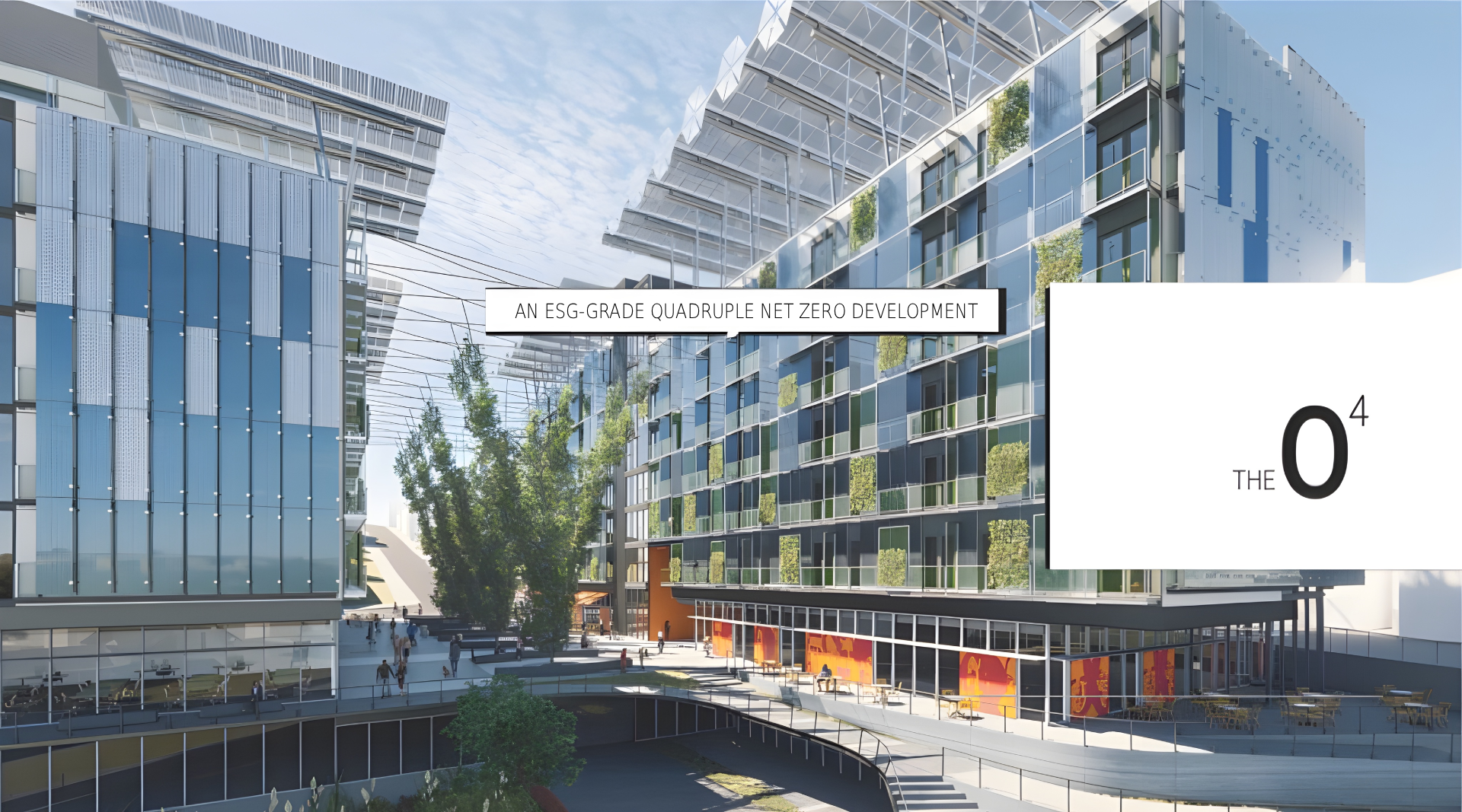

ESG-Rated

Sustainable Building & Real Estate